LinkedIn has become an invaluable platform for professionals. People use it to connect, network, and explore business opportunities. But with its growing popularity have come some red flags. There has been an increase in the presence of fake LinkedIn sales bots.

These bots impersonate real users and attempt to scam unsuspecting individuals. This is one of the many scams on LinkedIn. According to the FBI, fraud on LinkedIn poses a “significant threat” to platform users.

In this blog post, we will delve into the world of fake LinkedIn sales bots. We’ll explore their tactics and provide you with valuable tips. You’ll learn how to spot and protect yourself from these scams. By staying informed and vigilant, you can foster a safer LinkedIn experience.

Identifying Fake LinkedIn Sales Connections

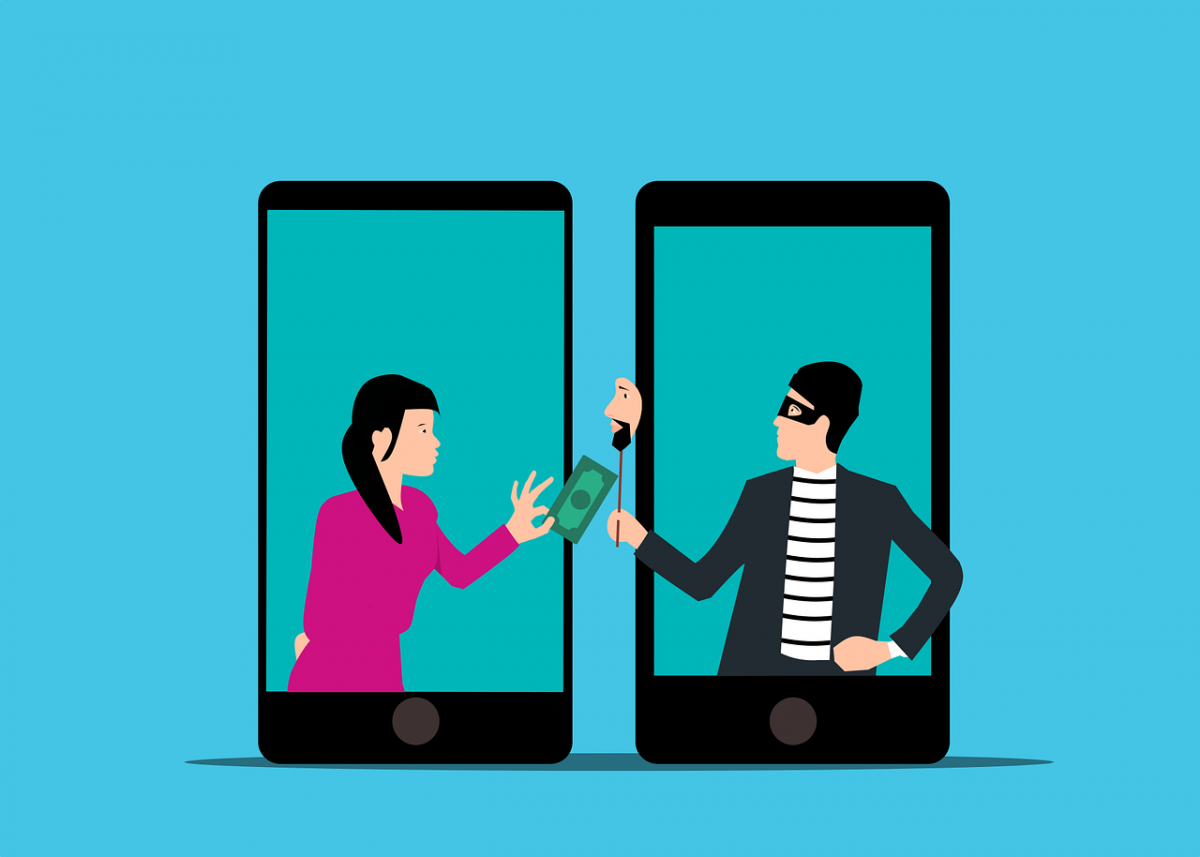

Social media scams often play on emotions. Who doesn’t want to be thought of as special or interesting? Scammers will reach out to connect. That connection request alone can make someone feel wanted. People often accept before researching the person’s profile.

Put a business proposition on top of that, and it’s easy to fool people. People that are looking for a job or business opportunity may have their guard down. There is also an inherent trust people give other business professionals. Many often trust LinkedIn connections more than Facebook requests.

How can you tell the real requests from the fake ones? Here are some tips on spotting the scammers and bots.

Incomplete Profiles and Generic Photos

Fake LinkedIn sales bots often have incomplete profiles. They’ll have very limited or generic information. They may lack a comprehensive work history or educational background. Additionally, these bots tend to use generic profile pictures. Such as stock photos or images of models.

If a profile looks too perfect or lacks specific details, it could be a red flag. Genuine LinkedIn users usually provide comprehensive information. They do this to establish credibility and foster trust among their connections.

Impersonal and Generic Messages

One of the key characteristics of fake sales bots is their messaging approach. It’s often impersonal and generic. These bots often send mass messages that lack personalization. They may be no specific references to your profile or industry. They often use generic templates or scripts to engage with potential targets.

Legitimate LinkedIn users, typically tailor their messages to specific individuals. They might mention shared connections, recent posts, or industry-specific topics. Exercise caution If you receive a message that feels overly generic. Or one that lacks personalization. Be sure to scrutinize the sender’s profile before proceeding further.

Excessive Promotional Content and Unrealistic Claims

Fake LinkedIn sales bots are notorious for bombarding users. You’ll often get DMs with excessive promotional content and making unrealistic claims. These bots often promote products or services aggressively. Usually without offering much information or value.

They may promise overnight success, incredible profits, or instant solutions to complex problems. Genuine professionals on LinkedIn focus on building relationships. They try to provide valuable insights and engage in meaningful discussions. Instead of resorting to constant self-promotion.

Be wary of connections that focus solely on selling. And that don’t offer any meaningful content or engagement.

Inconsistent or Poor Grammar and Spelling

When communicating on LinkedIn, pay attention to the grammar and spelling of messages. You may dismiss an error from an international-sounding connection, but it could be a bot.

Fake LinkedIn sales bots often display inconsistent or poor grammar and spelling mistakes. These errors can serve as a clear sign that the sender is not genuine. Legitimate LinkedIn users typically take pride in their communication skills. They try to maintain a high standard of professionalism.

If you encounter messages with several grammatical errors or spelling mistakes, exercise caution. Investigate further before engaging with the sender.

Unusual Connection Requests and Unfamiliar Profiles

Fake LinkedIn sales bots often send connection requests to individuals indiscriminately. They may target users with little regard for relevance or shared professional interests.

Be cautious when accepting connection requests from unfamiliar profiles. Especially if the connection seems unrelated to your industry or expertise.

Take the time to review the requesting profile. Check their mutual connections, and assess the relevance of their content. Legitimate LinkedIn users are more likely to have a connection. They typically send connection requests to others with shared interests or professional networks.

Need Training in Online Security?

Spotting fake LinkedIn sales bots is crucial for maintaining a safe online experience. By being vigilant, you can protect yourself from potential scams.

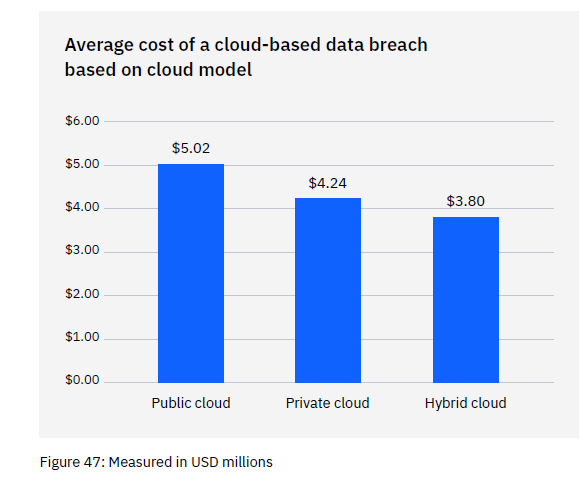

AI is causing an increase in the sophistication of scams. You may need some help navigating what’s real and fake. Employees can also benefit by learning social media security.

Need help with personal or team cybersecurity training? We have a team of friendly experts that can improve your scam detection skills.

Contact TN Techs today to discuss your online security.

This Article has been Republished with Permission from The Technology Press.